When it comes to trading, recognizing patterns can make or break your strategy. One powerful technique gaining traction is the Big Small Trend Chart Pattern. This trading pattern helps traders identify critical turning points and market trends, enabling more informed decisions. Whether you’re a novice trader or an expert looking to refine your skills, understanding this pattern is crucial. Let’s explore how this technique can elevate your trading game.

What is the Big Small Trend Chart Pattern?

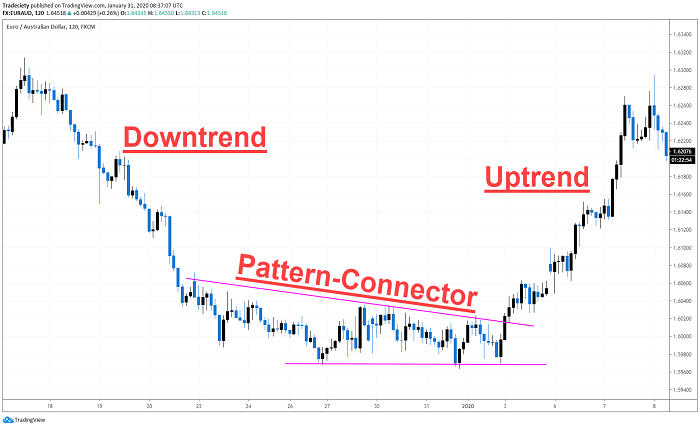

The Big Small Trend Chart Pattern is a visual representation used in technical analysis to capture market movements. It involves alternating big and small price actions or candlesticks, which signify potential market reversals or continuations. This pattern is particularly valuable in volatile markets, where trends can shift rapidly. By identifying these “big” and “small” movements, traders can gain insights into the market’s momentum and plan their strategies accordingly.Incorporating the Big Small Trend Chart Pattern into your trading toolkit allows you to predict market movements with greater confidence. This pattern is not just a theory but a practical tool used by seasoned traders to identify trends and make profitable trades.

Why the Big Small Trend Chart Pattern Matters in Trading

The significance of the Big Small Trend Chart Pattern lies in its ability to simplify complex market data. Traditional technical indicators often overwhelm traders with information, but this pattern narrows the focus to two primary movements: large shifts indicating significant market action and smaller ones signaling potential consolidation or indecision.

For traders, mastering the Big Small Trend Chart Pattern can mean the difference between riding a profitable wave and missing an opportunity. By focusing on these patterns, traders can better understand when to enter or exit positions, reducing risks and improving overall returns.

How to Identify the Big Small Trend Chart Pattern

Identifying the Big Small Trend Chart Pattern involves careful observation of charts and candlestick formations. Here’s a step-by-step guide:

- Recognize Big Candlesticks: These indicate strong momentum, either bullish or bearish, and often precede trend shifts.

- Spot Small Candlesticks: Smaller price movements usually signal market indecision or a pause before a continuation or reversal.

- Look for Alternation: The key feature of the pattern is the alternation between big and small candlesticks, creating a clear visual cue.

- Analyze Context: Consider the broader market context to confirm whether the pattern aligns with other indicators or trends.

By systematically applying these steps, you can effectively incorporate the Big Small Trend Chart Pattern into your trading analysis.

Common Variations of the Big Small Trend Chart Pattern

The Big Small Trend Chart Pattern is not a one-size-fits-all strategy. Traders often encounter variations that can offer additional insights:

- Big-Small-Big Sequence: Suggests a breakout after consolidation.

- Small-Big-Small Sequence: Indicates a potential reversal after a sharp movement.

- Big-Big-Small Patterns: Signal overextension and potential pullbacks.

Understanding these variations allows traders to adapt their strategies to different market conditions while staying rooted in the principles of the Big Small Trend Chart Pattern.

Advantages of Using the Big Small Trend Chart Pattern

The Big Small Trend Chart Pattern offers several benefits that make it indispensable for traders:

- Clarity in Analysis: Simplifies complex charts by focusing on alternating big and small movements.

- Enhanced Timing: Helps pinpoint optimal entry and exit points.

- Versatility: Can be applied across various markets, including forex, stocks, and cryptocurrencies.

- Risk Reduction: Improves decision-making by highlighting clear trends and reversals.

- Scalability: Suitable for both short-term and long-term trading strategies.

By leveraging the Big Small Trend Chart Pattern, traders can achieve greater precision in their trades, leading to consistent profitability.

How to Implement the Big Small Trend Chart Pattern in Your Strategy

Implementing the Big Small Trend Chart Pattern requires integrating it with your overall trading plan. Here are actionable steps:

- Choose the Right Tools: Use charting platforms that provide clear candlestick visualizations.

- Combine with Other Indicators: Enhance the pattern’s reliability by pairing it with moving averages, RSI, or Fibonacci retracements.

- Set Clear Goals: Define your profit targets and stop-loss levels based on the pattern’s signals.

- Backtest Your Strategy: Test historical data to validate the effectiveness of the Big Small Trend Chart Pattern in your chosen market.

- Stay Disciplined: Avoid emotional trading by sticking to the signals provided by the pattern.

Integrating the Big Small Trend Chart Pattern into your strategy ensures a disciplined approach, reducing impulsive decisions and maximizing returns.

Common Mistakes to Avoid with the Big Small Trend Chart Pattern

Even experienced traders can misinterpret the Big Small Trend Chart Pattern. Avoid these pitfalls:

- Overanalyzing Minor Movements: Focus on significant patterns rather than every small fluctuation.

- Ignoring Context: Always consider market conditions and other indicators.

- Excessive Risk: Don’t overleverage based solely on the pattern; use it as one part of a broader strategy.

- Lack of Practice: Practice identifying the pattern in different market scenarios before using it in live trading.

- Neglecting Risk Management: Always use stop-losses to protect against unexpected market moves.

By avoiding these mistakes, traders can fully harness the potential of the Big Small Trend Chart Pattern.

Conclusion

The Big Small Trend Chart Pattern is a powerful tool for traders seeking clarity in complex markets. By focusing on the interplay between large and small movements, this pattern offers valuable insights into market trends and momentum. When used correctly, it enhances decision-making, reduces risks, and boosts profitability. Whether you’re trading stocks, forex, or cryptocurrencies, incorporating the Big Small Trend Chart Pattern into your strategy can significantly improve your results. Start practicing today to unlock its full potential.

FAQs

1. What is the Big Small Trend Chart Pattern?

The Big Small Trend Chart Pattern is a trading strategy that identifies market trends using alternating big and small candlestick movements.

2. Can the Big Small Trend Chart Pattern be used in all markets?

Yes, this pattern is versatile and can be applied to forex, stocks, cryptocurrencies, and commodities.

3. Is the Big Small Trend Chart Pattern suitable for beginners?

Absolutely. The pattern’s simplicity makes it an excellent tool for traders at all levels, including beginners.

4. How reliable is the Big Small Trend Chart Pattern?

When combined with other indicators and proper analysis, it can be a highly reliable tool for identifying trends and reversals.

5. What tools are needed to use the Big Small Trend Chart Pattern?

A charting platform with candlestick visualization is essential. Pairing it with technical indicators like RSI or moving averages is recommended for better accuracy.