Gold has long been regarded as a valuable and reliable investment, serving as a store of wealth and a hedge against inflation. The gold rate trend can significantly impact investors’ strategies, whether they are buying, selling, or holding the precious metal. In this blog post, we will dive deep into the factors influencing the gold rate trend, what to expect in the coming months, and how you can make informed decisions based on this trend. Whether you’re a seasoned investor or someone looking to diversify your portfolio, understanding the gold rate trend is essential.

The Basics of Gold Rate Trend: What It Is and Why It Matters

The gold rate trend refers to the movement of gold prices over time. These fluctuations can happen on a daily, monthly, or yearly basis and are driven by several factors, including global economic conditions, geopolitical events, currency values, and investor behavior. Tracking the gold rate trend is crucial for individuals and institutions that hold or intend to buy gold, as the price of gold can have a direct impact on their financial outcomes.The price of gold is often quoted in troy ounces, with market prices set through global exchanges like the New York Mercantile Exchange (NYMEX) and London Bullion Market Association (LBMA). Investors closely monitor the gold rate trend to determine the right time to enter or exit the market.

Key Factors That Influence the Gold Rate Trend

Several critical factors play a role in determining the gold rate trend, making it essential for investors to stay informed about these influences. Here are some of the primary factors:

- Global Economic Stability: Economic events such as recessions, inflation, and changes in interest rates can affect the price of gold. When markets are unstable, investors tend to flock to gold as a safe haven.

- Inflation and Currency Depreciation: Gold is often seen as a hedge against inflation. When currencies like the U.S. Dollar lose value, gold typically rises in price as people look for stable investments.

- Geopolitical Tensions: Wars, trade disputes, and political instability can drive the gold rate trend upwards, as investors seek security in gold during uncertain times.

- Interest Rates: Central banks, such as the U.S. Federal Reserve, play a vital role in shaping the gold rate trend. When interest rates rise, gold can lose its appeal compared to income-generating assets, leading to price declines.

- Supply and Demand: The supply of gold from mining operations and demand from industries, jewelry makers, and investors also influences the gold rate trend.

By closely following these factors, investors can better predict the gold rate trend and take advantage of price fluctuations to maximize their returns.

The Impact of Global Events on the Gold Rate Trend

Global events such as economic crises, pandemics, and major geopolitical events can dramatically influence the gold rate trend. For example, the COVID-19 pandemic saw a surge in gold prices as investors rushed to safe-haven assets due to global economic uncertainty. Similarly, political events like Brexit and trade wars have historically led to higher gold prices as investors seek refuge from market volatility.Understanding how global events impact the gold rate trend is crucial for making informed investment decisions. In periods of crisis, gold tends to perform better than other assets, providing a cushion against losses in stocks and bonds.

Understanding Long-Term Gold Rate Trends

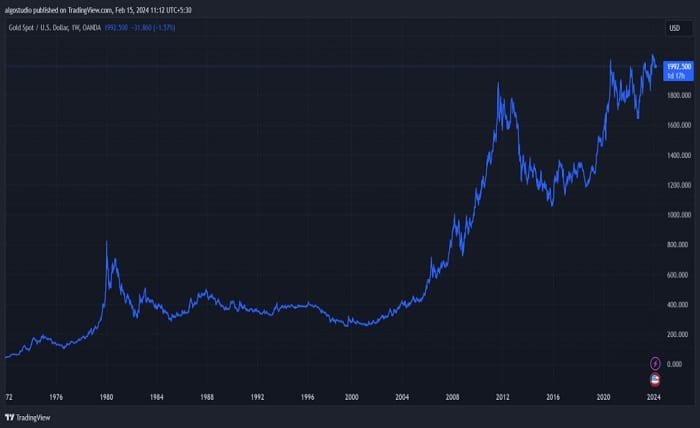

While short-term fluctuations are common, long-term trends in the price of gold provide valuable insights into how gold can fit into an investment strategy. Over the past few decades, the gold rate trend has shown a consistent upward trajectory, particularly during times of economic instability.Long-term investors often view gold as a way to preserve wealth over time, especially during inflationary periods. The gold rate trend over the long term also reflects the overall demand for the precious metal, driven by both investors and industries such as technology and jewelry.Historical data indicates that gold prices have risen steadily during major global economic crises, including the 2008 financial crisis, when gold reached new highs. The trend was further amplified by the U.S. dollar’s depreciation, making gold more appealing in the global market.

Gold Rate Trend in 2024: What to Expect

Looking ahead to 2024, the gold rate trend remains closely tied to several key factors. Analysts expect the price of gold to continue fluctuating due to geopolitical risks, central bank policies, and inflation concerns.With inflation rates still elevated in many parts of the world, gold is expected to maintain its role as a hedge against rising prices. Additionally, central banks are likely to continue their cautious approach to interest rates, making gold a more attractive option compared to other investments. However, the strength of the U.S. dollar will remain a critical factor in determining the gold rate trend.If global economic conditions stabilize and inflation subsides, the price of gold could face downward pressure. On the other hand, if uncertainties persist, the gold rate trend could see a continuation of upward momentum.

How to Invest Based on the Gold Rate Trend

Investors can use the gold rate trend as a key indicator for making investment decisions. There are various ways to invest in gold, each with its own advantages and risks:

- Physical Gold: Buying gold coins or bars allows investors to directly hold the metal. This is a safe method but requires secure storage.

- Gold ETFs: Exchange-traded funds allow investors to gain exposure to gold without having to own physical gold. These funds track the price of gold and can be traded on the stock market.

- Gold Mining Stocks: Investing in gold mining companies offers indirect exposure to gold prices. If gold prices rise, mining companies’ stock values typically follow suit.

- Futures and Options: For more experienced investors, trading gold futures and options contracts can offer opportunities for substantial returns, albeit with greater risk.

By understanding the gold rate trend and how different investment vehicles react to gold price movements, investors can make smarter decisions that align with their financial goals.

Risks and Considerations When Investing in Gold

While gold is often seen as a safe-haven asset, it is not without its risks. The gold rate trend can be volatile, particularly in the short term. For instance, sudden changes in interest rates or the U.S. dollar’s strength can lead to sharp fluctuations in gold prices.It’s also important to remember that gold does not generate income like stocks or bonds. Therefore, it may not be the best option for investors seeking regular income, such as dividends or interest. Moreover, the cost of storing physical gold can add an additional layer of expense.Diversifying your portfolio by including gold, alongside other asset classes such as stocks and bonds, can help manage risk while benefiting from the potential upsides of the gold rate trend.

Conclusion

The gold rate trend is a crucial consideration for any investor looking to protect wealth and navigate economic uncertainty. By understanding the various factors that influence the price of gold—such as global economic conditions, inflation, and geopolitical risks—you can make informed decisions about when and how to invest in gold.With ongoing global instability and inflationary pressures, gold is expected to remain a valuable asset in 2024. However, careful attention to the gold rate trend is necessary to determine the optimal time to enter or exit the market.Whether you choose to invest in physical gold, gold ETFs, or gold mining stocks, it’s important to understand the risks and rewards associated with each option. By monitoring the gold rate trend and adapting your strategy accordingly, you can position yourself to take advantage of the long-term benefits that gold has to offer.

FAQs

- What drives the gold rate trend? The gold rate trend is influenced by factors like global economic stability, inflation, interest rates, geopolitical tensions, and demand from investors and industries.

- Is gold a good investment in 2024? Gold is expected to remain a strong investment in 2024 due to inflation concerns and geopolitical risks, making it a popular choice as a safe-haven asset.

- How can I track the gold rate trend? The gold rate trend can be tracked through financial news sources, commodity exchanges, and online platforms that provide real-time gold price data.

- What are the risks of investing in gold? Risks of investing in gold include price volatility, storage costs for physical gold, and the lack of income generation compared to other investments like stocks or bonds.

- Should I buy gold now or wait? The decision to buy gold depends on your investment goals and market conditions. If you believe that economic instability or inflation will persist, buying gold may be a wise decision. However, always consider diversifying your portfolio to manage risk effectively.