Introduction

Stock price Roku has captured the attention of investors due to its significant fluctuations and promising growth in the streaming industry. Known as a leading player in streaming services and digital media, Roku has positioned itself as a top choice among consumers and investors. This article explores the factors that affect the stock price of Roku and provides insights into its performance, potential, and risks.

A Brief History of Roku and its Market Presence

The stock price Roku story begins with the company’s inception in 2002. Founded by Anthony Wood, Roku aimed to simplify television streaming by offering affordable and efficient solutions. With the launch of its streaming players, Roku gained popularity and became a household name in the United States. This popularity translated into rapid growth and, eventually, a successful IPO in 2017. Since its debut on the NASDAQ, the stock price Roku has seen impressive growth, with investors flocking to the company as the streaming market expanded.

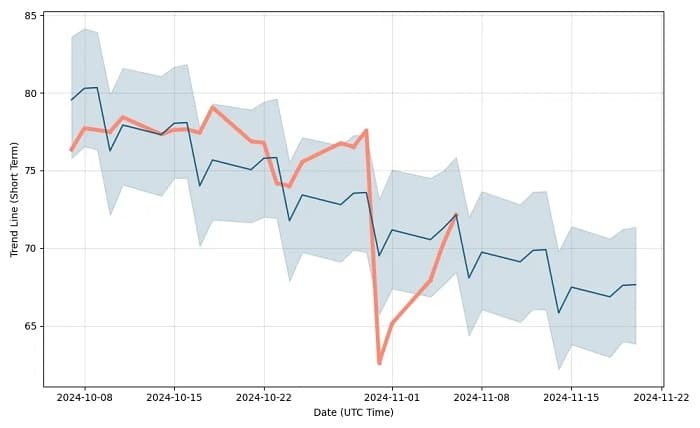

Analyzing Roku’s Stock Price Performance Over Time

When assessing the stock price Roku, it’s essential to look at its performance trajectory. Roku’s stock has experienced notable highs and lows, often driven by quarterly earnings reports, market sentiment, and broader economic conditions. Since its IPO, the stock price Roku has been marked by periods of rapid growth followed by corrections. This volatility reflects Roku’s position within a highly competitive and dynamic industry, where investor sentiment and streaming trends play a significant role.

Key Factors Influencing Roku’s Stock Price

Several factors influence stock price Roku, including competition, subscriber growth, and content partnerships. As more streaming services emerge, Roku faces competition from platforms like Amazon Fire TV, Google Chromecast, and Apple TV. Additionally, Roku’s ability to attract more subscribers and offer diverse content affects its stock value. Any updates on strategic partnerships with streaming giants can lead to a surge in Roku’s stock price as these collaborations enhance user experience and drive revenue growth.

The Impact of Quarterly Earnings on Roku’s Stock Price

roku stock is highly sensitive to its quarterly earnings reports. Investors closely analyze Roku’s financial results, focusing on revenue, active accounts, and average revenue per user (ARPU). Positive earnings reports often result in a boost in Roku’s stock price, while lower-than-expected results can lead to a decline. The company’s advertising revenue, subscription growth, and hardware sales are scrutinized as they provide insights into Roku’s profitability and growth potential in the coming quarters.

Roku’s Business Model and Revenue Streams

Understanding stock price Roku requires insight into the company’s business model. Roku generates revenue through three main streams: platform revenue, advertising, and hardware sales. Platform revenue includes licensing and subscriptions, while advertising contributes significantly due to the popularity of ad-supported streaming. Hardware sales, while lower-margin, continue to attract customers to Roku’s ecosystem. This diversified business model has a strong influence on Roku’s stock price, as each revenue stream contributes to its financial stability.

The Role of Advertising in Roku’s Stock Price

Advertising plays a pivotal role in stock price Roku due to its substantial contribution to revenue. Roku’s ad-supported channels attract advertisers, creating a lucrative revenue source that offsets the lower margins from hardware sales. As more consumers prefer ad-supported content, Roku’s advertising revenue has surged, leading to a positive impact on its stock price. Investors see this as a stable income source, making Roku an attractive stock in the media and tech sectors.

External Market Factors Impacting Roku’s Stock Price

The stock price Roku is also influenced by external market factors such as the overall stock market trends, interest rates, and economic stability. Like many tech stocks, Roku’s price tends to react to changes in interest rates, investor confidence, and geopolitical events. During economic downturns, discretionary spending on streaming may decrease, affecting Roku’s revenue and, consequently, its stock price. Understanding these external factors is vital for investors looking to predict Roku’s stock movements.

Roku’s Stock Price Compared to Competitors

A comprehensive analysis of stock price Roku involves comparing it to competitors like Netflix, Disney, and Amazon. While each competitor has a distinct business model, Roku’s position as an aggregator rather than a content creator sets it apart. Unlike content-driven giants, Roku’s strength lies in its platform, which supports multiple streaming services. This unique approach influences its stock performance, as investors appreciate Roku’s versatility and lesser dependence on content production.

Read more about : however synonym

Predicting the Future of Roku’s Stock Price

Forecasting stock price Roku involves considering growth prospects in the streaming industry, Roku’s international expansion, and potential challenges. With the global shift towards streaming and cord-cutting, Roku is well-positioned to capitalize on this trend. Its plans for expansion in international markets and efforts to enhance platform capabilities could positively impact its stock price. However, increased competition and regulatory concerns may pose risks, requiring investors to monitor developments closely.

Conclusion

In conclusion, stock price Roku remains a compelling option for investors interested in the streaming and digital media sector. With a strong market position, diverse revenue streams, and growing advertising potential, Roku has a favorable outlook. However, it’s crucial to consider the inherent volatility and market competition that may impact the stock. As streaming demand continues to rise, Roku stands to benefit, making it an intriguing investment opportunity for those with a tolerance for stock market fluctuations.

FAQs

Q1. What factors influence the stock price Roku?

A1. The stock price Roku is influenced by competition, subscriber growth, earnings reports, and external market factors.

Q2. How does Roku generate revenue?

A2. Roku’s revenue comes from advertising, platform licensing, and hardware sales, which support its overall financial health.

Q3. How is Roku’s stock price affected by quarterly earnings?

A3. Quarterly earnings reports have a significant impact on Roku’s stock price, as investors react to revenue and subscriber metrics.

Q4. Does advertising impact Roku’s stock price?

A4. Yes, advertising revenue is a major driver for Roku’s stock price, thanks to the popularity of ad-supported streaming on its platform.

Q5. Is Roku a good stock to invest in for the future?

A5. Roku has strong growth potential in streaming but also faces competition and market volatility, making it a dynamic investment choice.