The L&T Technology share price has been a focal point of interest for investors and market analysts alike due to its consistent performance and prominence in the engineering and technology sectors. As part of the broader Larsen & Toubro conglomerate, L&T Technology Services (LTTS) operates as a leading player in engineering research and development (ER&D), with a global presence and a diverse range of service offerings. Understanding the factors influencing the L&T Technology share price is essential for investors looking to make informed decisions in today’s volatile market. This blog post provides a comprehensive analysis of the L&T Technology share price, exploring its historical performance, current trends, and future potential.

History of L&T Technology Services and Stock Performance

The journey of L&T Technology Services (LTTS) began in 2016 when it was listed on the Indian stock exchanges, marking its debut in the stock market. Since then, the L&T Technology share price has witnessed substantial growth, driven by the company’s strong financials and its leadership position in the global ER&D market. Over the years, L&T Technology’s share price has demonstrated resilience during market fluctuations and economic downturns, supported by the company’s diversified portfolio and steady revenue growth. Understanding the stock’s historical performance is crucial for investors assessing the long-term value of L&T Technology share price in their portfolios.

Factors Influencing the L&T Technology Share Price

Several factors influence the L&T Technology share price, from the company’s internal financial performance to external market dynamics. Key drivers include:

- Revenue Growth and Profit Margins: As the company consistently expands its revenue base through new contracts and global operations, the L&T Technology share price reacts positively.

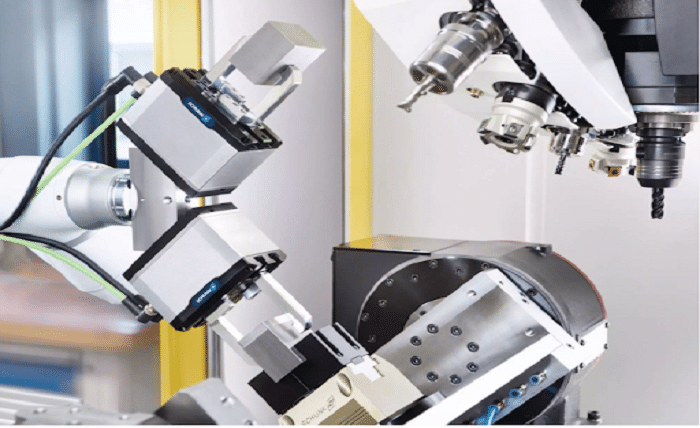

- Industry Trends in ER&D: The growing demand for digital transformation, automation, and innovation in sectors like automotive, aerospace, and healthcare directly impacts L&T Technology’s share price.

- Macroeconomic Factors: Economic conditions, inflation, interest rates, and geopolitical events can influence the L&T Technology share price.

- Technological Advancements: LTTS’s focus on cutting-edge technologies like AI, IoT, and 5G development affects investor sentiment and the L&T Technology share price.

By closely monitoring these factors, investors can gain better insight into the performance trajectory of L&T Technology’s share price.

Recent Trends in L&T Technology Share Price

The L&T Technology share price has experienced notable fluctuations in recent years due to a combination of market volatility, global economic uncertainties, and shifts in industry demand. In the post-pandemic recovery phase, L&T Technology’s share price saw an uptick as industries accelerated their digital transformation initiatives. Additionally, the company’s increasing focus on emerging technologies and strategic partnerships has boosted investor confidence, contributing to upward momentum in the L&T Technology share price. Recent trends indicate that the stock remains attractive for long-term investors, especially given the company’s expanding global footprint and consistent financial growth.

How Market Sentiment Impacts L&T Technology Share Price

Market sentiment plays a significant role in shaping the L&T Technology share price, particularly in response to major corporate announcements, quarterly earnings reports, and external economic factors. Positive news, such as winning large contracts or launching innovative services, tends to boost investor confidence, leading to a rise in the L&T Technology share price. Conversely, any negative developments, such as missed earnings expectations or global economic downturns, can cause a temporary dip in the L&T Technology share price. By staying attuned to market sentiment, investors can make strategic decisions on when to buy or sell L&T Technology shares.

L&T Technology Financial Performance and Its Effect on Share Price

The financial health of L&T Technology Services is a critical determinant of the L&T Technology share price. The company has consistently delivered strong financial results, with growing revenue streams, profitability, and a solid balance sheet. In particular, the quarterly earnings reports provide insight into the company’s performance across key segments, helping to forecast potential movements in the L&T Technology share price. Investors keen on tracking the stock’s value should pay close attention to financial metrics such as earnings per share (EPS), return on equity (ROE), and free cash flow, as these metrics often correlate with fluctuations in the L&T Technology share price.

Long-term Investment Potential of L&T Technology Share Price

Investors with a long-term outlook should consider the growth prospects of L&T Technology’s share price. The company operates in sectors that are poised for significant expansion, such as digital engineering, smart manufacturing, and sustainable technologies. These industries present opportunities for continued growth, making L&T Technology’s share price a strong candidate for long-term investment portfolios. Additionally, L&T Technology’s ability to adapt to evolving market needs and maintain leadership in the ER&D space reinforces the stock’s potential for future appreciation. Investors focused on long-term capital growth may find the L&T Technology share price to be a valuable addition to their strategy.

Risks Associated with L&T Technology Share Price

While the L&T Technology share price has shown consistent performance, investors should be aware of the potential risks involved. Market volatility, particularly in the technology sector, can lead to fluctuations in the L&T Technology share price. Additionally, the company operates in a highly competitive environment, and any delays in adopting new technologies or challenges in executing large projects could affect its stock value. Global economic downturns, changes in regulatory policies, and currency exchange rate fluctuations are other factors that may pose risks to the L&T Technology share price. Understanding these risks is crucial for investors looking to mitigate potential downsides.

Expert Predictions on the Future of L&T Technology Share Price

Market analysts and financial experts have offered varied predictions regarding the future trajectory of the L&T Technology share price. Many experts remain bullish on the stock, citing the company’s strong fundamentals, diversified portfolio, and leadership in high-growth sectors such as 5G and AI as key reasons for their optimism. Analysts project that L&T Technology’s share price could continue its upward trend, especially as global demand for advanced engineering services grows. However, some caution that external economic conditions and potential market corrections could introduce volatility. Keeping an eye on expert opinions and reports can provide valuable insight for investors tracking the L&T Technology share price.

Key Investment Strategies for L&T Technology Share Price

To make the most of L&T Technology’s share price, investors should adopt well-researched strategies tailored to their risk tolerance and financial goals. A long-term buy-and-hold strategy may be suitable for investors who believe in the company’s sustained growth prospects. For short-term traders, market timing and technical analysis of the L&T Technology share price may offer opportunities to capitalize on price swings. Diversifying investments and keeping a portion of one’s portfolio in defensive assets can also help mitigate the impact of market volatility on the L&T Technology share price. Ultimately, understanding market dynamics and staying informed are key to successful investment strategies.

Conclusion

The L&T Technology share price is an attractive option for investors seeking exposure to the rapidly evolving engineering and technology sectors. With a strong track record of financial performance, industry leadership, and a focus on innovation, L&T Technology Services remains a solid contender in the stock market. Understanding the factors that influence the L&T Technology share price, including market sentiment, financial health, and external risks, is essential for investors aiming to make informed decisions. By staying informed about the company’s performance and industry trends, investors can confidently navigate the fluctuations of the L&T Technology share price and unlock long-term value.

FAQ

1. What is the current L&T Technology share price?

The L&T Technology share price fluctuates regularly due to market conditions. For the most up-to-date price, investors can check financial news platforms, stock market apps, or the official stock exchange websites where L&T Technology Services is listed.

2. What factors impact the L&T Technology share price?

Several factors influence the L&T Technology share price, including the company’s financial performance, industry trends, macroeconomic conditions, technological advancements, and market sentiment. Positive earnings reports or major contracts often drive the stock higher, while external economic challenges may lead to short-term declines.

3. Is L&T Technology’s share price a good long-term investment?

Many analysts consider the L&T Technology share price a strong long-term investment due to the company’s leadership in the ER&D sector, its growing global presence, and its focus on emerging technologies. However, investors should consider market conditions and their individual financial goals before investing.

4. What risks should I be aware of when investing in L&T Technology shares?

Risks associated with investing in L&T Technology share price include market volatility, economic downturns, competitive pressures, and potential disruptions in the global supply chain. Investors should also consider currency fluctuations and regulatory changes that may impact the stock’s value.