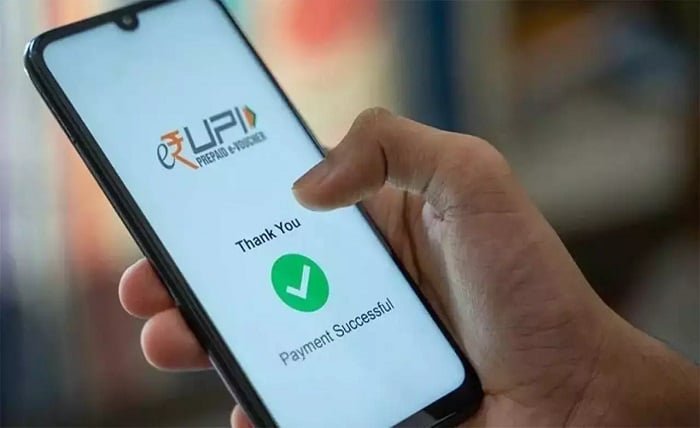

Digital payments became popular and UPI has become a favorite for many people. UPI, which stands for Unified Payments Interface, is a system that allows you to transfer money instantly between bank accounts using your smartphone. It’s easy to use, and you don’t need to remember or share complex bank details. In this guide, we’ll discuss how you can link multiple bank accounts to your UPI ID using a UPI app, so you can manage your finances more efficiently.

What is UPI and a UPI ID?

UPI is a real-time payment system that lets you transfer money between different bank accounts instantly. Developed by the National Payments Corporation of India (NPCI), UPI has simplified digital payments. Whether you need to send money to a friend, pay for groceries, or make online purchases, UPI can handle it all with just a few taps on your smartphone.

To make these payments, each user needs a UPI ID. This UPI ID is a unique identifier linked to your bank account. It’s like an email ID but for your money. When you want to send or receive money, all you need to do is share your UPI ID instead of sharing your entire bank account details.

Can You Have Multiple UPI IDs?

Yes, you can have multiple UPI IDs, even if they are linked to the same mobile number. For example, you might have a UPI ID linked to one bank account and another UPI ID linked to a different bank account, both associated with the same mobile number. It’s also possible to generate multiple UPI IDs within the same bank if you prefer to separate your transactions.

How to Add Bank Accounts to UPI

If you’re ready to start using UPI for your payments, here’s how you can link your bank account to a UPI app:

- Launch your UPI app: Open the UPI app that you’ve downloaded from a trusted app store like Google Play Store or Apple App Store.

- Find “Add Bank Account”: Look for an option in the app that says “Add Bank Account,” “Link Bank Account,” or something similar.

- Choose your bank: Select the bank where you have an account. The app will show a list of banks that it supports, so just pick yours from the list.

- Enter your details: You will need to provide your bank account number and the mobile number that’s linked to this account. Sometimes, you might also need to enter debit card details for verification.

- Verification process: The app will verify your account by sending a one-time password (OTP) to your registered mobile number. Enter this OTP to confirm that the bank account is yours.

- Create a UPI PIN: Once your account is verified, you’ll be prompted to create a UPI PIN. This is a 4 or 6-digit code that you’ll use to authorize transactions. Make sure it’s something you can remember easily but is hard for others to guess.

Steps to Link Multiple Bank Accounts with UPI

Linking multiple bank accounts to UPI is a straightforward process:

- Open your UPI app: Ensure you are using the official UPI app from a trusted app store.

- Locate the “Add Bank Account” option: This could be in the settings, profile section, or directly on the home screen.

- Select your bank: Choose the bank where you hold the account you want to link.

- Enter account details: Provide your bank account number, mobile number, and debit card details if required.

- Complete verification: Enter the OTP sent to your registered mobile number.

- Set up UPI PIN: Create your UPI PIN to authorize future transactions.

Can You Link One UPI ID Across Multiple Accounts?

While you can link multiple bank accounts to different UPI IDs, you cannot link a single UPI ID to multiple bank accounts simultaneously. Each bank account you link will generate a unique UPI ID. This means that if you have two bank accounts, you’ll have two separate UPI IDs, each linked to its respective bank account.

Why Link Multiple Bank Accounts?

Linking multiple bank accounts to UPI offers several benefits:

- Flexibility: You can choose which bank account to use for different transactions.

- Convenience: No need to switch between apps or log into different accounts. Everything is managed through one UPI app.

- Better control: You can keep track of your spending across different bank accounts easily.

Conclusion

UPI has made managing finances easier than ever. By linking multiple bank accounts to your UPI app, you can enjoy a secure way to handle your money and other UPI Offers. Whether you’re paying bills, sending money to friends, or shopping online, UPI offers a quick and reliable solution. Remember, each bank account will have its unique UPI ID, giving you full control over your transactions.

For a hassle-free experience in managing your finances, consider using the Bajaj Finserv UPI app. It offers a user-friendly interface and multiple UPI offers that can enhance your digital payment experience. Whether you have one bank account or several, Bajaj Finserv makes it easy to manage them all in one place.